WhatsApp Pay

Pay with India’s favourite messenger app!With over 390 million users, WhatsApp is probably the most used app in India. WhatsApp Pay harnesses UPI - India’s widely used payment system - to deliver a safe, quick, and easy payment option. Read how to pay, receive funds, and more in our WhatsApp Pay review.

Check out our Top WhatsApp Pay Casinos in India

WhatsApp Pay Review – Safety First!

WhatsApp Pay is a payment feature launched by WhatsApp, the popular instant messaging app owned by Meta. It’s an in-chat payment method that allows users to make payments to their contacts.

WhatsApp Pay is based on UPI – the popular Indian payment system, which makes it similar to PayTM, Google Pay, and other UPI-based payment options out there.

To use WhatsApp Pay, users don’t have to install a separate app – the feature is already available in the messenger app. Needless to say that WhatsApp is secure, and the app doesn’t store your UPI PIN or bank credentials.

The security, privacy and compliance of WhatsApp Pay is taken care of by WhatsApp India, RBI, and NCPI. As per their guidelines, UPI users’ data is encrypted and stays within the country’s territory.

As far as casino payments are concerned, users can pay with WhatsApp Pay wherever UPI payments are accepted. However, ensure that the casino you’re signing up for is licenced and regulated.

To save you some time, our team of experts at IndiaCasinos has reviewed and hand-picked the best casinos for Indian iGamers.

| Did You Know? |

|---|

| India has over 390 million WhatsApp users – which is more than any other country in the world. Brazil and the US also have a large WhatsApp user base. Together, these countries have over half a billion WhatsApp users. |

How to Use WhatsApp Pay at Online Casinos?

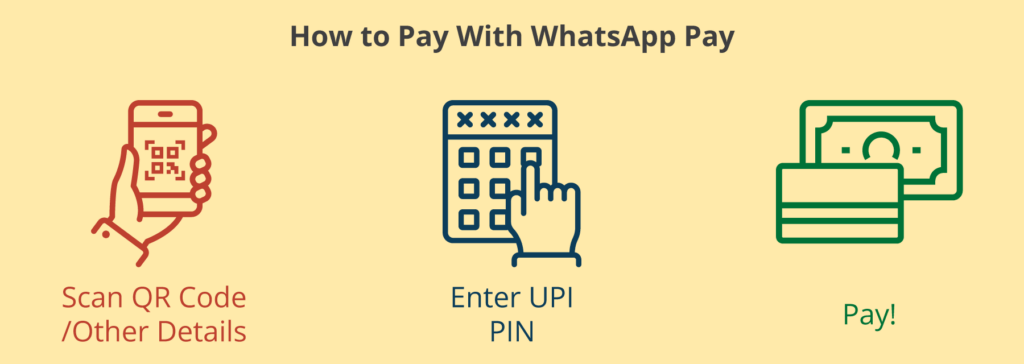

As mentioned earlier, WhatsApp Pay is similar to Google Pay, PayTM, and other payment apps based on UPI. This means, users can pay others with a contact number, UPI ID, QR code, or bank details.

Before you start paying and receiving money with WhatsApp Pay, you have to set it up. Getting started is easy; all you have to do is – add your bank account details and verify those. Once activated, you will have to set up a PIN.

Further, there are a few important things to note:

- WhatsApp Pay lets you add 5 bank accounts

- To use WhatsApp Pay, you need to use the SAME phone number that is registered with your bank

Coming to casino payments, iGamers can deposit and withdraw funds using WhatsApp Pay. In fact, the messenger payment feature can be used at any casino that enables UPI-based payments.

Simply put, WhatsApp Pay should work wherever Google Pay, PhonePe, and other payment apps are accepted.

Are There Any Fees When Depositing and Withdrawing at the WhatsApp Casino?

As is the case with all UPI-based payment options, there are no transaction fees applicable. Similarly, WhatsApp transactions incur no additional fees as the platform is powered by UPI.

How to Place a Deposit and Withdraw Your Winnings Using WhatsApp Pay?

Depositing and withdrawing funds is simple. Here’s a rundown on how to deposit and withdraw funds using WhatsApp.

Deposit

- To pay using WhatsApp, visit the ‘payments’ or ‘banking’ page of the online casino and get the banking details. It can be a QR code, UPI ID, or you will get a payment prompt on your app.

- Approve the payment, enter the UPI PIN, and wait a few seconds for the transaction to process.

A successful transaction will be followed by the amount getting deducted from your bank.

Withdrawal

To withdraw, input your UPI ID and wait for the funds to be released to you. As soon as the funds arrive, you will be notified on WhatsApp Pay.

| Did You Know? |

|---|

| In 2022, PhonePe accounts for 46% of UPI usage. Meanwhile, Google Pay follows with 34% of the total usage. |

Solutions to Common Issues When Using WhatsApp Pay at Online Casinos

At times, you might face some technical issues while using WhatsApp Pay (or other UPI payment apps for that matter). Here are solutions to some common problems encountered while using WhatsApp Pay.

- The amount has been debited from my account, but the transaction was unsuccessful. What do I do?

In cases where the transaction is deemed ‘failed’ but the amount gets deducted from the bank, it is usually refunded, or it reaches the receiver. In either case, you will have to wait for a few business days to see where the amount gets reflected. You can contact the WhatsApp Pay customer service to get help.

- Why can’t I add my bank account to WhatsApp Pay?

If you cannot see your bank’s name in the list while setting up WhatsApp Pay, it is likely that your bank doesn’t support UPI.

Here are a few more reasons why you’re unable to set up:

- Your WhatsApp number and the number registered with the bank are different

- You’re unable to receive SMS for verification

- Internet connectivity issues

For more details, visit WhatsApp Pay’s official website and browse through the FAQs.

| Did You Know? |

|---|

| In August 2022, over 6.57 billion transactions were processed over UPI. |

Pros and Cons of Using WhatsApp at Online Casinos

| PROS | CONS |

|---|---|

| Fast, secure, and easy | Not as popular as other UPI-based methods |

| Powered by UPI | |

| Easily accessible as it’s a built-in feature in WhatsApp |

WhatsApp Pay vs. Other Payment Methods

As discussed earlier, WhatsApp Pay is similar to other UPI-based payment methods like Google Pay, PhonePe, and others. When it comes to sending and receiving funds, WhatsApp Pay doesn’t differ much.

The biggest difference is that you don’t have to install a separate app, as the payment feature can be enabled in WhatsApp messenger itself. Further, users can send money to other users (who have enabled WhatsApp Pay) directly in the chat.

| Features | WhatsApp Pay | PayTM | RuPay | Google Pay |

|---|---|---|---|---|

| Instant Payment | ✔ | ✔ | ✔ | ✔ |

| Quick Payments | ✔ | ✔ | ✖ | ✔ |

| Safe & Secure | ✔ | ✔ | ✔ | ✔ |

Check out other popular payment methods for desi iGamers.

| Did You Know? |

|---|

| WhatsApp Pay was first introduced in 2018, but it was in 2020 that NCPI gave permission for integration with UPI. Since then, the payment feature has been released and becoming available to users. |

Conclusion: Paying is As Easy As Texting

If you are familiar with Google Pay, PhonePe, PayTM, and other similar apps, then you’ll find it easy to use WhatsApp Pay. To set up the payment feature, enable it on your WhatsApp, enter your banking details, and complete the verification.

After activation, you will be able to make payments using contact numbers, QR codes, UPI IDs, and other banking details. WhatsApp Pay is still new, compared to Google Pay or PhonePe. However, it works similarly with the added in-chat payment feature.